News

GoldHaven Resources to Acquire Interest in 5 Additional Projects in the Chilean Maricunga Gold Belt & Announces $4M Non-Brokered Private Placement.

August 12, 2020

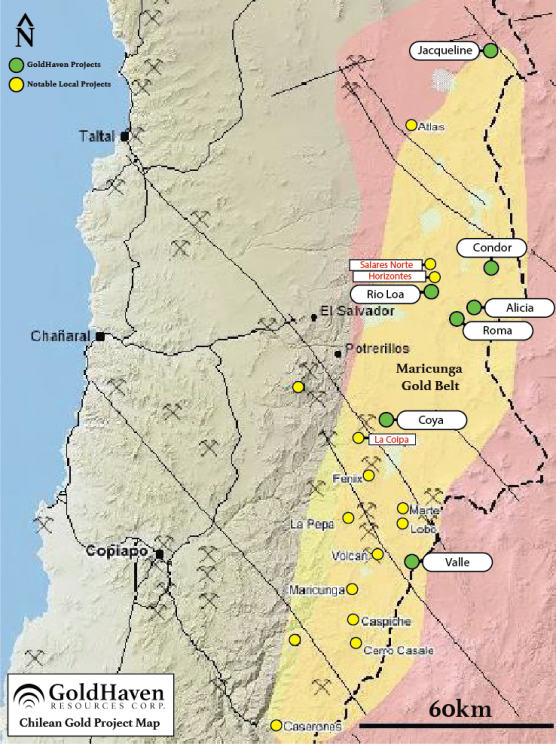

Vancouver, British Columbia–(Newsfile Corp. – August 12, 2020) – GoldHaven Resources Corp. (CSE: GOH) (the “Company” or “GoldHaven”) announces it has reached an agreement with a private company (the “Vendor”) whereby it will acquire (the “Maricunga Acquisition”) the Vendor’s interest in a letter of intent (the “LOI”) to acquire a 100% interest in five gold projects (the “Maricunga Projects”) in the prolific Maricunga precious metals belt in Chile (the “Maricunga Belt”).

The five Maricunga Acquisition Projects cover a total area of approximately 22,600 hectares or 226 sq. km located in the northern portion of the Maricunga Belt in proximity to the 4.1M oz AuEq Salares Norte project owned by Gold Fields Limited. Gold Fields recently announced (April 2020) its intention to proceed with the development of Salares Norte at a cost of US$860M, with a US$138M expenditure budgeted for 2020.

The Maricunga Belt extends approximately 150 km north-south and 30 km east-west, straddling the border between Chile and Argentina. This region hosts known mineral resources of more than 100M oz Au, 450M oz Ag and 1.3B lbs. Cu.

The Maricunga Projects opportunity came about as a result of a US$150 million initiative launched by the Chilean Economic Development Agency (“CORFO”) with the objective of encouraging exploration and mining prosperity in Chile and in order to strengthen Chile’s position as a world leader in the sector. (See Chile Explore Report No. 65, July 2018 at https://chilexploregroup.cl/wp-content/uploads/2019/04/CER65_ENG-nopassword.pdf).

As part of CORFO’s program, a total of US$15.3M was given to the private equity fund IMT Exploration and was used to evaluate 403 projects beginning in 2011. This led to a generative program carried out between 2016 to 2019, resulting in 126 potential epithermal targets from which 57 field evaluations were made and followed by due diligence work on 19 of these. Work programs were then conducted, including geological mapping, rock and soil sampling and TerraSpec (PIMA) analyses on geochemical grids for alteration mapping and, as a result, the five-high priority Maricunga Projects were identified. No drilling has been carried out on any of the Maricunga Projects.

David Smith, GoldHaven’s President, commented, “We are very encouraged by the quality of the technical information that we have received on the Maricunga Projects in connection with our due diligence.” Mr Smith continued, “We expect to enter into definitive agreements for the properties in the near term and to be able to readily identify drill targets on these properties. We believe that this puts GoldHaven in a unique position amongst precious metals-focused junior resource companies in Chile.”

Together with GoldHaven’s letters of intent to acquire the Rio Loa and Coya properties (the “Rio Loa / Coya Acquisition”) (see new release dated April 17, 2020), GoldHaven now has interests in letters of intent to acquire seven properties in the Maricunga (collectively, the “Chilean Projects”).

GoldHaven plans to begin work on these projects following the end of the Chilean winter and once COVID-19 travel restrictions are lifted in Chile.

Terms of Acquisition

The Maricunga Acquisition is expected to be affected by way of share exchange, whereby GoldHaven will acquire all of the issued and outstanding shares of the Vendor in consideration for 6,000,000 shares of GoldHaven. Pursuant to the LOI, the Vendor has the exclusive right to negotiate a definitive property option agreement to acquire a 100% interest in the Maricunga Projects, subject to a 2% net smelter returns royalty retained by the underlying property owners. To exercise the option, the Company would be required to make cash payments to the underlying property owners in the aggregate sum of USD $8,445,000 and to complete exploration activities on the Maricunga Projects, as follows:

| Date | Option Payments (USD) | Exploration Commitments |

| On the later of the Closing Date and the Deadline Date | $20,000 | — |

| On or before the first anniversary of the Closing Date | $75,000 | 3,000m drilling |

| On or before the second anniversary of the Closing Date | $100,000 | Additional 5,000m drilling |

| On or before the third anniversary of the Closing Date | $250,000 | Additional 5,000m drilling |

| On or before the fourth anniversary of the Closing Date | $2,000,000 | Election by the Company of (i) drill program (“4th Drill Program”) or (ii) preliminary economic assessment (“PEA”), having a cost of at least USD $1,300,000 and to be completed by fifth anniversary of the Closing Date. |

| On or before the fifth anniversary of the Closing Date | $6,000,000 | Completion of the 4th Drill Program or the PEA. |

| TOTAL: | $8,445,000 |

Notes:

(1) The “Closing Date” is anticipated to take place on or about September 15, 2020.

(2) The “Deadline Date” is the date which is 60 days following the removal of all travel, accommodation, movement and other restrictions intended to combat the spread of the coronavirus disease (COVID-19) imposed by Chilean governmental, state and local authorities.

Equity Financing

GoldHaven also announces a non-brokered private placement (the “Offering”) of 11,500,000 units (the “Units”) at a price of $0.35 per Unit, for gross proceeds of $4,025,000. Each Unit will consist of one share of the Company (each, a “Share”) and one share purchase warrant (each, a “Warrant”). Each Warrant entitles the holder to acquire one additional share of the Company for a period of 18 months from the date of issuance at a price of $0.50 per share. In the event that the Company’s shares trade at a closing price of greater than $0.65 per share for a minimum of ten consecutive days at any time after the closing of the Offering, the Company may accelerate the expiry date of the Warrants by providing notice to the holders thereof and, in such case, the Warrants will expire on the 30th day after the date on which such notice is given by the Company.

Finder’s fees may be payable to arm’s length parties that have introduced GoldHaven to certain subscribers participating in the Offering.

All securities issued in connection with the Offering are subject to a four month and one day hold period in Canada. The closing of the Offering is subject to all necessary regulatory approvals.

The net proceeds from the Offering are intended to be used to fund general expenses, and exploration and drilling of its mineral properties.

This news release does not constitute an offer of sale of any of the foregoing securities in the United States. None of the foregoing securities have been and will not be registered under the U.S. Securities Act of 1933, as amended (the “1933 Act”) or any applicable state securities laws and may not be offered or sold in the United States or to, or for the account or benefit of, U.S. persons (as defined in Regulation S under the 1933 Act) or persons in the United States absent registration or an applicable exemption from such registration requirements. This news release does not constitute an offer to sell or the solicitation of an offer to buy nor will there be any sale of the foregoing securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

About GoldHaven Resources Corp.

GoldHaven is a mineral exploration and resource development company focused on identifying economically viable resource opportunities in the Americas.

For more information, please visit us online at the following URLs:

Website: www.goldhavenresources.com

Facebook: https://www.facebook.com/GoldHavenResources

Twitter: https://twitter.com/GoldHavenCorp

LinkedIn: https://www.linkedin.com/company/goldhaven-resources

On Behalf of the Board of Directors

David C. Smith, President and Director

For further information, please contact:

| David C Smith President T: (604) 638-5938 |

or | Marla Ritchie Corporate Secretary T: 604-638-3886 |

Forward-Looking Statements:

This news release contains forward-looking statements and forward-looking information (collectively, “forward- looking statements”) within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, statements regarding the closing of the Maricunga Acquisition and the Rio Loa / Coya Acquisition (collectively, the “Acquisitions”), the expectation that drill target can be identified on all or some of the Chilean Projects, the amount of the Offering, the intended use of proceeds from the Offering, the Company’s expectation that it will be successful in enacting its business plans and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: “will”, “expects”, “anticipates”, “intends”, “estimates”, “plans”, “may”, “should”, “potential”, “believes”, “scheduled”, or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that the Company will be successful in completing the Acquisitions, that all or some of the Chilean Projects are drill ready, the completion of the Offering, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the Acquisitions, future exploration and development of the Company’s projects in a timely manner, including the Chilean Projects, the availability of financing on suitable terms for the exploration and development of the Company’s projects and the Company’s ability to comply with environmental, health and safety laws.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements. Such risks and other factors include, among others, operating and technical difficulties in connection with mineral exploration and development activities, actual results of exploration activities, the fact that the Company has not yet acquired any of the Chilean Projects and, when acquired, the Company’s interests in certain portions of the Chilean Projects and its other mineral properties will be and are only options and there is no guarantee that these interests, if earned, will be certain, the estimation or realization of mineral reserves and mineral resources, the inability of the Company to obtain the necessary financing required to conduct its business and affairs, as currently contemplated, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of precious metals, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in the Offering and in future financings, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, risks relating to epidemics or pandemics such as COVID-19, including the impact of COVID-19 on the Company’s business, financial condition and exploration and development activities, changes in laws, regulations and policies affecting mining operations, title disputes, the inability of the Company to obtain any necessary permits, consents, approvals or authorizations, including of the Canadian Securities Exchange with respect to the Acquisitions and the Offering, the timing and possible outcome of any pending litigation, environmental issues and liabilities, and risks related to joint venture operations, and other risks and uncertainties disclosed in the Company’s latest interim Management’s Discussion and Analysis and filed with certain securities commissions in Canada. All of the Company’s Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

Readers are cautioned that the Company has no interest in or right to acquire any interest in Gold Field’s Salares Norte project, and that mineral deposits, and the results of any mining thereof, on adjacent or similar properties are not indicative of mineral deposits on the Company’s properties or any potential exploitation thereof.