News

GoldHaven Discovers Two Hydrothermal Alteration Zones by Initial Drilling at Alicia and Roma Gold Projects in the Maricunga District, northern Chile

October 6, 2021

Vancouver, British Columbia--(October 6, 2021) - GoldHaven Resources Corp. (CSE: GOH) (OTCQB: GHVNF) (FSE: 4QS) ("GoldHaven" or the "Company") reports that initial drilling on the Alicia and Roma high sulphidation gold exploration projects in the Maricunga Gold District, north-central Chile has resulted in the discovery of two hydrothermal alteration zones.

Daniel Schieber, CEO of GoldHaven stated “The encouraging Phase I drill results at Alicia and Roma yielded two high priority targets. Thanks to our world-class technical team, the program came in under-budget and is a strong showcase of efficient exploration to potential strategic partners. We anticipate more significant results to come starting Q4 2021.”

Figure 1. The locations of GoldHaven’s Alicia and Roma projects with respect to Salares Norte (Gold Fields).

The newly discovered alteration zones contain anomalous pathfinder elements and favourable alteration mineralogy identified using short wave infrared spectrometry (“SWIR”; see below). The SWIR survey results suggest that there may be potential for deeper gold and/or silver targets in these areas. These anomalies will be integrated into ongoing exploration targeting at the Alicia and Roma Gold projects.

Initial drill results suggest that GoldHaven has identified a large, highly prospective region of hydrothermal alteration including multiple targets which may contain epithermal gold mineralization. GoldHaven intends to conduct follow up exploration drilling on two targets identified in this round of drilling. Furthermore, at least 8 additional, large untested targets remain within the Alicia-Roma properties. In total, there are 12 targets identified by GoldHaven that occur within a Maricunga Belt scale regional NW-SE structural trend that includes Gold Fields’ Salares Norte deposit (5.2 million ounces gold equivalent2, currently under construction); which is located 30 to 35 km to the northwest.

Drilling Summary

Drill holes ALSAR-21-001 and RMSAR-21-002 contain compelling alteration mineralogy and pathfinder element responses that are interpreted to represent a distal epithermal gold environment. Additional exploration will be conducted with the objective to vector toward one or more potentially gold-mineralized zones. Due to the positive results obtained in holes ALSAR-21-001 and RMSAR-21-002 as well as the large number of untested anomalies remaining, a Phase II drill program is in preparation to begin between Q4 2021 and Q1 2022 and crews are being mobilized for pre-drilling studies to prioritize targets. This includes mapping and sampling of Phase I drill access roads, targeted backhoe trenching, sampling, spectrometry, extension of previous talus find sample lines as well as soil sample grid infill over the most significant anomalous zones. IP/Resistivity and CSAMT geophysics are also being considered. Follow up programs also remain to be initiated on the three remaining priority GoldHaven properties located within the Maricunga District, namely Jacqueline, Condor and Valle.

Phase I Exploration

A Phase I reconnaissance exploration program was conducted between March and April 2021 and included 5 reverse circulation holes (1,594 metres) designed to test 4 of a total of 12 priority targets defined by coincident surface geochemical gold and gold pathfinder anomalies associated with opaline and silica-alunite-kaolinite mineral assemblages hosted by dacitic-andesitic volcanic domes. The 12 targets initially delineated during project generation include 8 targets at Alicia and 4 at Roma. The targets range from a few hundred metres in diameter to a maximum of 2,500 metres long by 750 metres wide (Alicia Sur), with several covering more than 1 square kilometre in area. Note that of the four areas drilled three were tested with only one drillhole per target. As a comparison, the 1.5 Moz (17Mt@2,8 g/t) Puren deposit at La Coipa was a blind discovery made by drill hole #311.

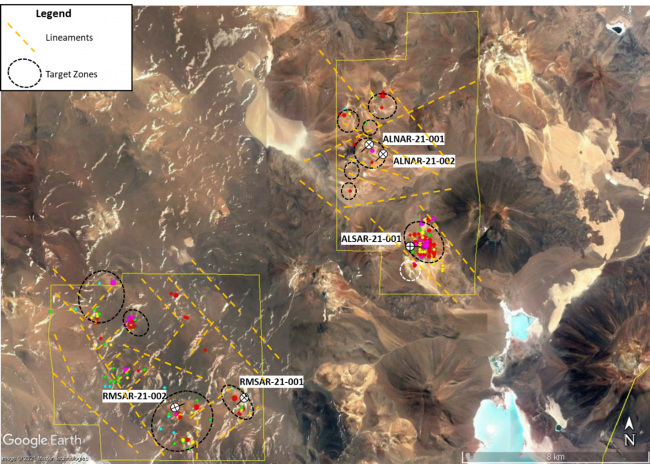

Figure 2. Dashed ovals outline target zones identified on the Alicia and Roma projects. A total of 4 were reconnaissance drill tested. Drill hole locations are labelled (small circles with crosses). Surface samples represented by coloured dots represent elevated values of pathfinder elements related to precious metals-high sulfidation deposits (As, Pb, Tl, Hg, Te, Se, Sb).

Exploration Drill Targeting Criteria:

- Surface grid-based geochemical soil anomaly.

- Favourable host rock consisting of dacitic-andesitic pyroclastic/tuffaceous sequences.

- Proximity to dome margins.

- Dominant brittle structural control within anomalies, the most evident being the northwest trend as well as possible structural intersections with northeast segmented structures, ring and concentric structures.

- The identification of preserved paleosurface (unconformity) and the favourable gold deposition elevation range or level of possible mineralization (e.g., approximately 4350m above sea level at Salares Norte and other mineralized systems in this portion of the Maricunga Gold Belt).

- Presence of high level, steam heated alteration, native sulfur, opaline silica.

An analysis of gold pathfinder or trace elements in soil samples along two main alteration trends revealed anomalies in As-Sb-Bi-Tl-In-Pb-Sn-Cd and Se-Te. The two main alteration trends include illite-muscovite and advanced argillic/steam heated alteration. These high-level alteration (steam-heated) zones are most intensely developed in holes ALSAR-21-001 and RMSAR-21-002 with the latter hole carrying partially oxidized pyrite.

Drill Hole Summaries

Hole ALSAR-21-001 returned anomalous montmorillonite/gypsum alteration in the upper part of the hole. This is interpreted to represent a high-level distal response to mineralization. Below this anomalous interval, the hole intersected dacite volcanic rocks interpreted to represent a volcanic dome. Since gold mineralization is often spatially associated with volcanic domes in epithermal settings follow up drilling will be considered. Anomalous thallium in this hole supports the presence of hydrothermal alteration.

Hole RMSAR-21-002 returned the strongest pathfinder element response (from 133 metres to 363 metres) in two hydrothermal zones (from 90 to 232 metres and 292 to 370 metres (bottom of hole and open at depth). The first interval is associated with gypsum/kaolinite and the second with montmorillonite. Partial oxidation of sulphides (pyrite) observed throughout this hole. The high Tl values in this hole are also considered indicative of a hydrothermal phase.

Holes ALNAR-21-001, ALNAR-21-002 and RMSAR-21-001 did not show any significant geochemical indication of being close to mineralization. This may reflect a paleo-elevation control and suggests these holes were collared too high in the system.

Digital Marketing Agreement

The Company has entered into a digital marketing agreement with Lion Capital Investment Limited. The agreement is for an initial term of twelve months at a cost of CAD$300,000. Lion Capital will provide financial publishing, digital marketing services and will raise public awareness of the company.

Qualified Person

Daniel MacNeil, P.Geo., a Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has read and approved all technical and scientific information contained in this news release.

About GoldHaven Resources Corp.

GoldHaven Resources is a Canadian precious metals exploration company focused on acquiring and unlocking highly prospective gold projects in the Central Newfoundland Gold Belt (Canada) & the Maricunga Gold Belt (Chile). All properties have large scale discovery potential and all properties in Chile are drill-ready. GoldHaven currently holds the Pat ’s Pond and O ’Neill projects covering approximately 228 square kilometres of mineral tenements in Newfoundland, Canada. The Company also holds seven Chilean projects; Rio Loa, Coya, Roma, Alicia, Condor, Jacqueline and Valle covering approximately 251 square kilometres; many in close proximity to renowned discoveries or large precious metals mines including Salares Norte (Gold Fields), Esperanza (TDG), La Coipa (Kinross), Cerro Maricunga (Fenix Gold), Lobo Marte (Kinross), Volcan (Volcan), Refugio (Kinross/Bema), Caspiche (Goldcorp/Barrick), Cerro Casale (Goldcorp/Barrick).

On Behalf of the Board of Directors

Daniel Schieber

For further information, please contact:

Bonn Smith

Head of Business Development

www.goldhavenresources.com

Office Direct: (604) 638-3073

REFERENCES

1Arribas, Antonio (Placer Dome, Reno, USA), Jose Luis Illanes, Carlos Peralta and Mario Fuentes (Mantos de Oro, Copiapo, Chile), May 2005. Geochemical study of the steam-heated cap above the Puren deposit, La Coipa mine, Chile. https://www.researchgate.net/publication/319272950_Geochemical_study_of_the_steam-heated_lithocap_above_the_Puren_deposit_La_Coipa_mine_Chile.

2Jamasmie, C., 2019. Gold Field’s Salares Norte project in Chile granted environmental permit. December 18, 2019, 9:29am. Exploration Intelligence Latin America Gold Silver. https://www.mining.com/gold-fields-salares-norte-project-in-chile-granted-environmental-permit/.

Neither the CSE nor its Regulation Services Provider (as that term is defined in the policies of the CSE- Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statements Regarding Forward Looking Information

This news release contains forward-looking statements and forward-looking information (collectively, "forward looking statements") within the meaning of applicable Canadian and U.S. securities legislation, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, the intended use of the proceeds received from the Offering, the possible acquisition of the Projects, the Company's expectation that it will be successful in enacting its business plans, and the anticipated business plans and timing of future activities of the Company, are forward-looking statements. Although the Company believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: "believes", "will", "expects", "anticipates", "intends", "estimates", "plans", "may", "should", "potential", "scheduled", or variations of such words and phrases and similar expressions, which, by their nature, refer to future events or results that may, could, would, might or will occur or be taken or achieved. In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, that investor interest will be sufficient to close the Offering, and the receipt of any necessary regulatory or corporate approvals in connection with the Offering and the Assignment, that there will be investor interest in future financings, market fundamentals will result in sustained precious metals demand and prices, the receipt of any necessary permits, licenses and regulatory approvals in connection with the future exploration and development of the Company's projects in a timely manner, the availability of financing on suitable terms for the exploration and development of the Company's projects and the Company's ability to comply with environmental, health and safety laws.

The Company cautions investors that any forward-looking statements by the Company are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, operating and technical difficulties in connection with mineral exploration and development activities, actual results of exploration activities, the estimation or realization of mineral reserves and mineral resources, the inability of the Company to obtain the necessary financing required to conduct its business and affairs, as currently contemplated, the inability to close the Offering, the inability of the Company to enter into definitive agreements in respect of the Letters of Intent which are the subject of the Assignment, the timing and amount of estimated future production, the costs of production, capital expenditures, the costs and timing of the development of new deposits, requirements for additional capital, future prices of precious metals, changes in general economic conditions, changes in the financial markets and in the demand and market price for commodities, lack of investor interest in future financings, accidents, labour disputes and other risks of the mining industry, delays in obtaining governmental approvals, permits or financing or in the completion of development or construction activities, changes in laws, regulations and policies affecting mining operations, title disputes, the inability of the Company to obtain any necessary permits, consents, approvals or authorizations, including by the Exchange, the timing and possible outcome of any pending litigation, environmental issues and liabilities, and risks related to joint venture operations, and other risks and uncertainties disclosed in the Company's latest interim Management's Discussion and Analysis and filed with certain securities commissions in Canada. All of the Company's Canadian public disclosure filings may be accessed via www.sedar.com and readers are urged to review these materials.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.